Don’t Wait For A Bargain: Buy A House Now

In 2019, Zillow predicted we would see a real estate crash in 2020 like we experienced in 2008. Their prediction was many months before the coronavirus pandemic swept across our nation. Once the coronavirus made its way to our shores, there were many more people predicting a 2020 housing market crash. All of these predictions about what would happen to the housing market were completely wrong. Over the course of 2020, home sales increased almost %19 percent above 2019 levels. Much of this had to do with people trying to take advantage of historically low mortgage rates. As good as home sales were last year, many sat on the sidelines waiting for early pandemic predictions to play out. Many sat back and waited for the crash, so that they could buy a house at a bargain. The data is clear. Don’t wait for a bargain. Buy a house now.

What the Data Says about Buying a Home

If you are hoping to wait out today’s red hot real estate market and buy a home at a bargain, you might be very disappointed. There is a lot of data that points to 2021 being another great year for the housing market. If you are one of these people who are hoping for a bargain, it is hard to blame you. Housing prices increased dramatically in 2020. One of the first rules of finance that everyone learns is ‘buy low; sell high’.

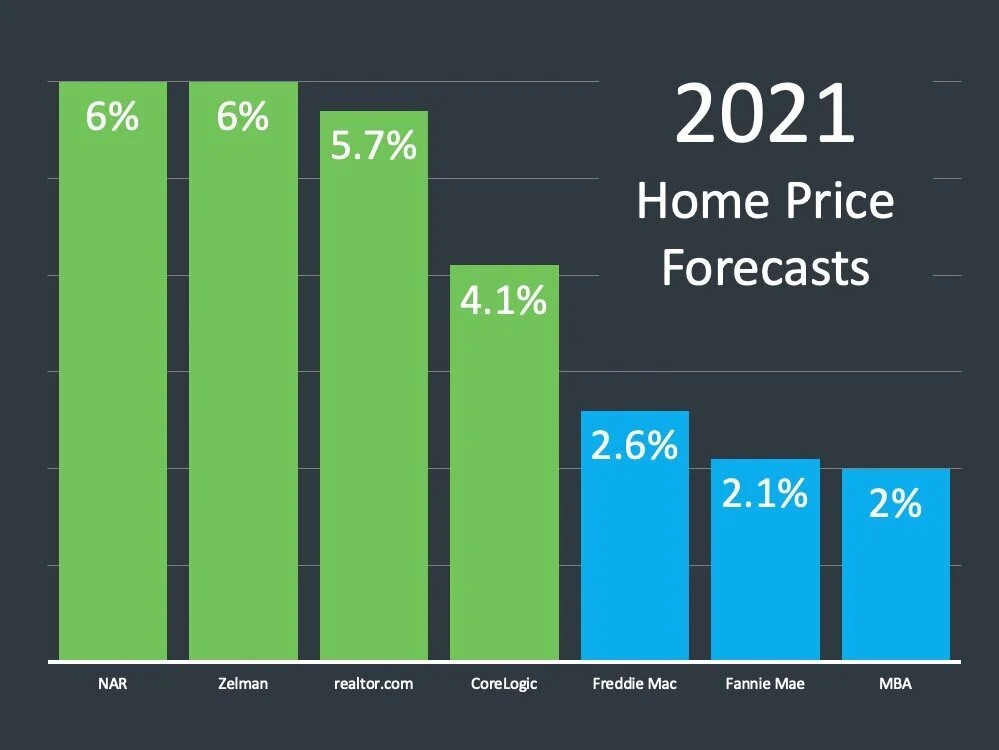

It is easy to understand the mindset of wanting to get in when the housing market is low. The problem with that mindset is you probably will not see those lows anytime soon. In fact, almost every market forecaster expects home prices to continue their upward trajectory in 2021. Take a look at the graph in this post, which lays out home price predictions by all of the best prognosticators. Even conservative estimates have home prices increasing by over 2%. If you think today’s prices are too much right now, there is a good chance you will think they are in fact a bargain in a few months.

Why Will Home Prices Increase in 2021?

Home prices are expected to increase in 2021 because of supply and demand. The demand for homes is very high because of rock bottom interest rates. However, the supply of available homes to purchase is really small. To understand what happens to the price it is important to look at whether or not the demand and/or supply of available homes will change in 2021.

Housing Supply in 2021

In 2020 the supply of available homes on the housing market decreased over 39% from 2019 levels. Those numbers are eye popping. Unfortunately for those waiting on prices to decrease, inventory probably will not improve in 2021. Home builders experienced a slowdown in 2020 due to the coronavirus. Many projects that were already in the works had to shut down due to restrictions designed to stem the tide of the pandemic. Even when work resumed, social distancing concerns and labor shortages meant that projects were going slower. The supply of homes is also being impacted by the supply of building materials.

Lumber is in particularly short supply all around the globe. There are a few reasons for this. First, natural disasters, such as the record number of hurricanes and the huge fires across the west are causing many to rebuild their homes. This is a lot of home construction that does nothing to increase the supply of available homes for purchase. Second, import restrictions due to the pandemic are also making it harder to get lumber from overseas. The limited supply of building materials is making it take longer for new homes to be built. However, even if the limited supply didn’t impact the speed of new projections, it is still increasing their cost. As lumber grows more expensive, so do the houses that are built from it. All of this points to the housing supply to remain low and house prices to remain high.

Housing Demand in 2021

While the supply of homes is not expected to increase in 2021, the demand is not expected to taper off in the short term. The demand for homes is being fueled by low mortgage rates. Mortgage rates are at all-time lows because the Federal Reserve has slashed interest rates to protect the economy from the pandemic. Mortgage rates jumped slightly in the first week of 2021, but they have since gone even lower. This tells you that the Federal Reserve is not optimistic that we are on the other side of the pandemic. As long as rates are low, people will want to buy new homes.

Even though we are not on the other side of the pandemic, there is good reason to hope we will be making our way toward the light at the end of the tunnel. Vaccination efforts are underway around the country and are picking up steam. Good news is already here. Coronavirus cases and hospitalizations are decreasing around the nation. If numbers continue in this direction and vaccinations pickup, we might be able to turn the corner on this pandemic. When that happens, the Federal Reserve might start to increase interest rates and mortgage rates will increase, too.

Even if mortgage rates increase in 2021, you shouldn’t expect that to crater the demand for home purchases. Our economy is still in recovery mode, so the Federal Reserve will be reluctant to raise rates too much too fast. Mortgage rates are at historic lows, so that can increase quite a bit before they are no longer a bargain. Plus, slight increases in rates might cause people to rush and try to buy their dream home due to FOMO. Potential home buyers have a fear of missing out and will jump off the sidelines and into the real estate market once it seems like deals are disappearing.

Final Thoughts

Everyone loves a bargain. However, waiting to buy a new home probably won’t help you get one. In fact, if you wait to buy the home you have been dreaming about, it’s more likely that you will realize that today’s prices are the bargain. Today’s real estate market is red hot and you shouldn’t take yourself out of it because house prices have increased. Even if you end up paying a little more than you expected, you won’t be disappointed. Once you have settled into the house of your dreams, paying a little more than you would have liked won’t matter. What matters is that you have the home of your dreams. If you don’t want to miss out on today’s low mortgage rates and want to own the home of your dreams right now, contact us! Our team of realtors will help you make your dream a reality.